Introduction

Introduction

FC Financial Holding is a leading international boutique investment bank in China that specializes in providing comprehensive capital value services to businesses. Our company is composed of experts with practical experience in fields such as investment banking, finance, law, marketing, management, and industrial integration. Our primary focus is on providing high-growth and promising domestic enterprises with all-encompassing, full-process, and all-stage capital navigation solutions.

History

History

In 2000, Mr. Wu Kezhong returned to China to engage in equity investments.

In 2002, Advantage Capital (China) Co., Ltd. was established, specializing in equity investment business.

In 2006, collaborated on the operation of the "Quanzhou Brand Enterprise Investment Promotion Center."

In 2007, FC Financial Holding's predecessor, Wealth China Financial Holdings Co., Ltd., was established to engage in investment banking business.

In 2016, they assisted over 40 enterprises in domestic and international IPO financing, raising over 40 billion RMB, and helped over 25 enterprises complete private financing of over 3 billion RMB.

In 2017, FC Financial Holding underwent restructuring, rebranded, and established Cai Zhong Beverly to provide management consulting services, forming an ecosystem for industrial investment banking.

In 2020, FC Financial Holding implemented the Three Major Middle-Office Strategy and established three major industrial middle offices: Life Sciences, Low-Carbon Environmental Protection, and New Generation Information Technology.

In 2021, FC Financial Holding added Cai Zhong Venture Capital, the GoIPO Capital Alliance, and Beyond Borders.

Service Mode

Service Mode

Due Diligence Resolution Solutions | Program Implementation Resource Connection We help companies gradually achieve compliance value, sustainable business growth, improved operational efficiency, and the integration of industrial resources. And we assist companies in connecting with various resources to rapidly enhance their overall value. | Capital Connection Value Realization As the level of enterprise value and compliance improves, the capital value of the enterprise is significantly enhanced. We help the company gradually connect with capital and finally achieve a complete connection between the company and the capital market, truly realizing the capital value. |

Service Mind

Service Mind

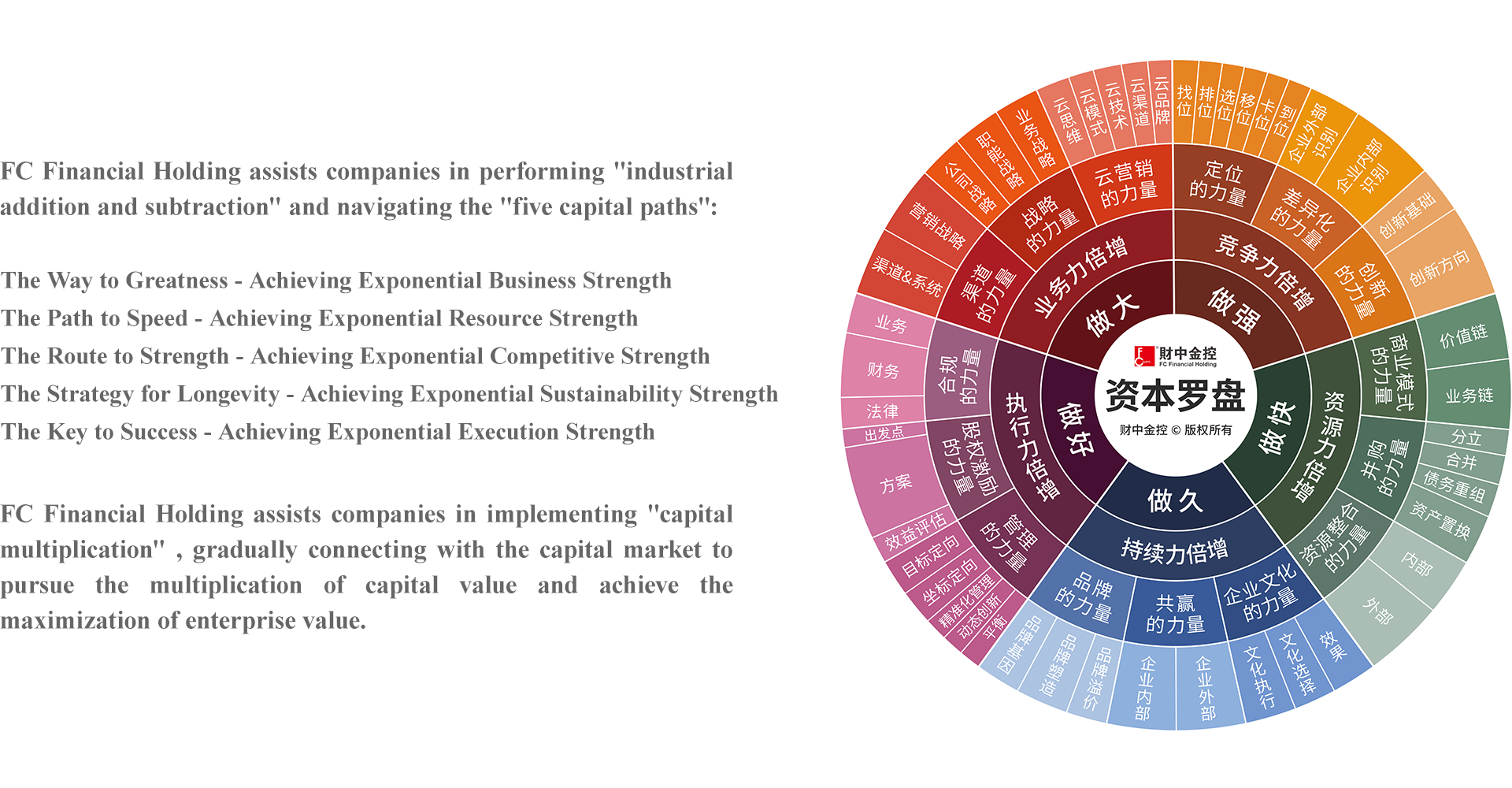

| From the perspectives of strategic planning, channel marketing, and cloud marketing, they clarify the company's strategic planning, expand the marketing capabilities and scale of various channels, thereby achieving a multiplication of the company's business force. |

| From the perspectives of positioning, differentiation, and innovation, they accurately position the company and its products, refine and cultivate differentiating features that set the company apart from competitors, and nurture and develop the company's continuous innovation capabilities, thus achieving a multiplication of the company's core competitiveness. |

| From various aspects of business models, mergers and acquisitions, and resource integration, they comprehensively integrate resources and assist the company in timely and moderate acquisitions of upstream and downstream businesses and competitors, thereby achieving a multiplication of the company's resource capabilities. |

| From the perspectives of branding, win-win mechanisms, and corporate culture, they reevaluate and enhance the company's brand, create win-win mechanisms suitable for internal and external stakeholders, and foster a unique corporate culture, thus achieving a multiplication of the company's sustainability. |

| From the perspectives of compliance, equity incentives, and management, they comprehensively standardize the company's legal, financial, and business practices, motivate employees and attract external talent through equity incentive tools, and enhance the overall management level of the company, thereby achieving a multiplication of the company's execution capabilities. |

TVC

TVC

Service Quotations

Service Quotations

A skyscraper doesn't rise from level ground; it's designed from the top down. To sustain your enterprise, everyone from upstream and downstream to partners, employees, and yourself must make money. There isn't much difference between a company with a sales volume of 100 million and 1 billion, just like running 1 meter or 10 meters in a 1,000-meter race—being ahead is more important than the distance.

The most valuable aspects of a company are invisible; the visible things often hold little value. When opening a restaurant, we often start by finding a good chef, but a truly successful restaurant business should not depend on chefs. Resource integration involves putting resources in the right place that were previously misplaced.

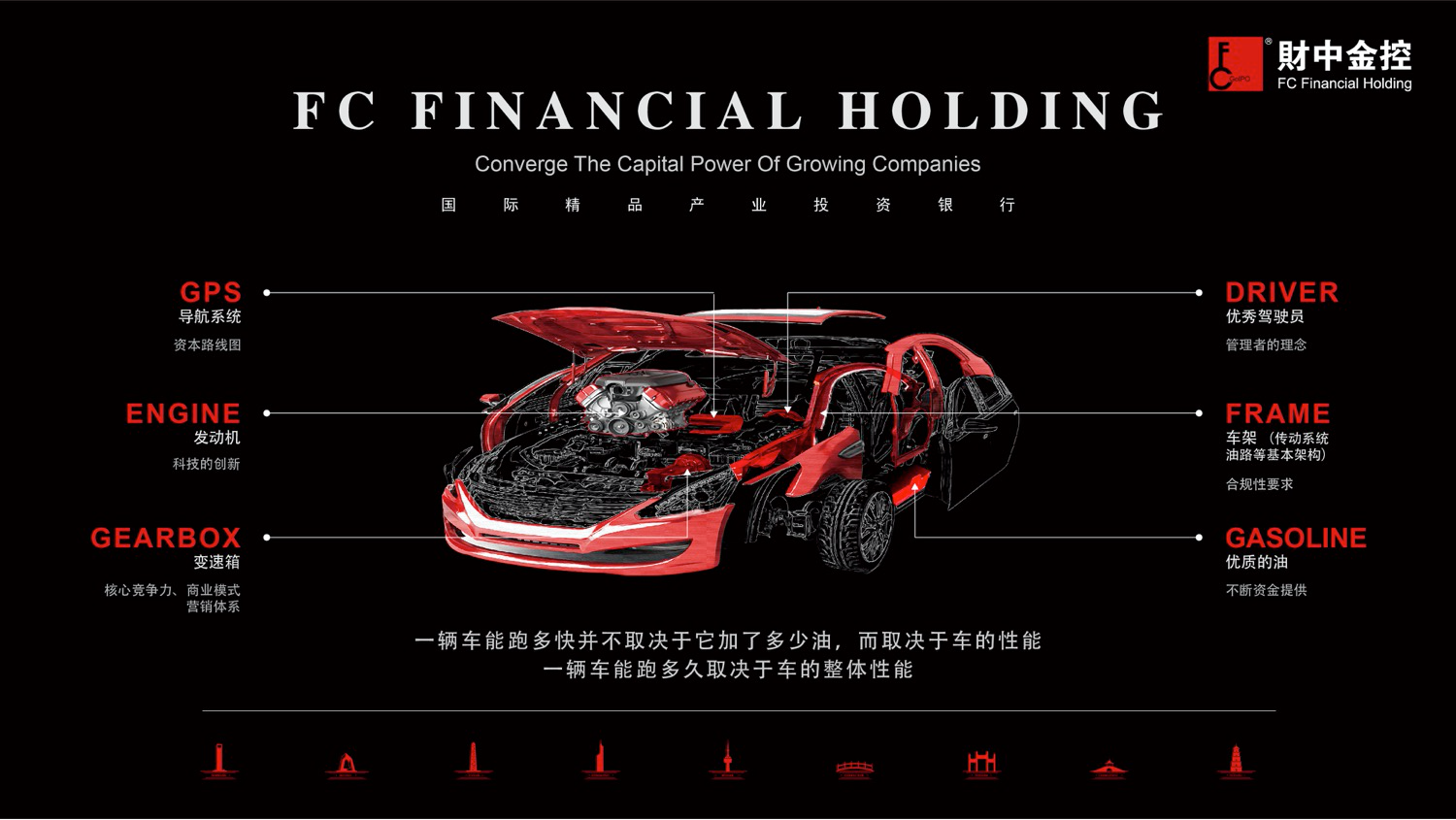

In the past, companies did as much as their funds allowed. Now, companies need funds to do as much as they want. In reality, companies often lack the ability to spend money, not capital. Capital can sometimes harm companies; it's like filling a Xiali car with fuel and racing it on a racetrack.

No product or technology can sustain a company for a lifetime. What sustains a company for a lifetime isn't the product or technology. A product only needs to score 70, and it may not be the best product that makes a great company. No one says McDonald's food is delicious, but it's the world's largest restaurant chain. No one says Lipton tea is the best, but it's the world's largest tea company. Some companies grow bigger only to die faster, like brand agencies. The difference between manufacturers and operators is akin to hunting and domestication.